workers comp taxes texas

Employer costs for unemployment insurance and workers compensation are relatively low in Texas. Corporate officers and LLC Members who are not excluded from coverage must utilize a minimum annual payroll of 7800 and a maximum payroll of 62400 in order to calculate the cost of.

Is Workers Comp Taxable Do You Have To File Workers Compensation Income On Tax Returns Are Workmans Compensation Settlements Taxable

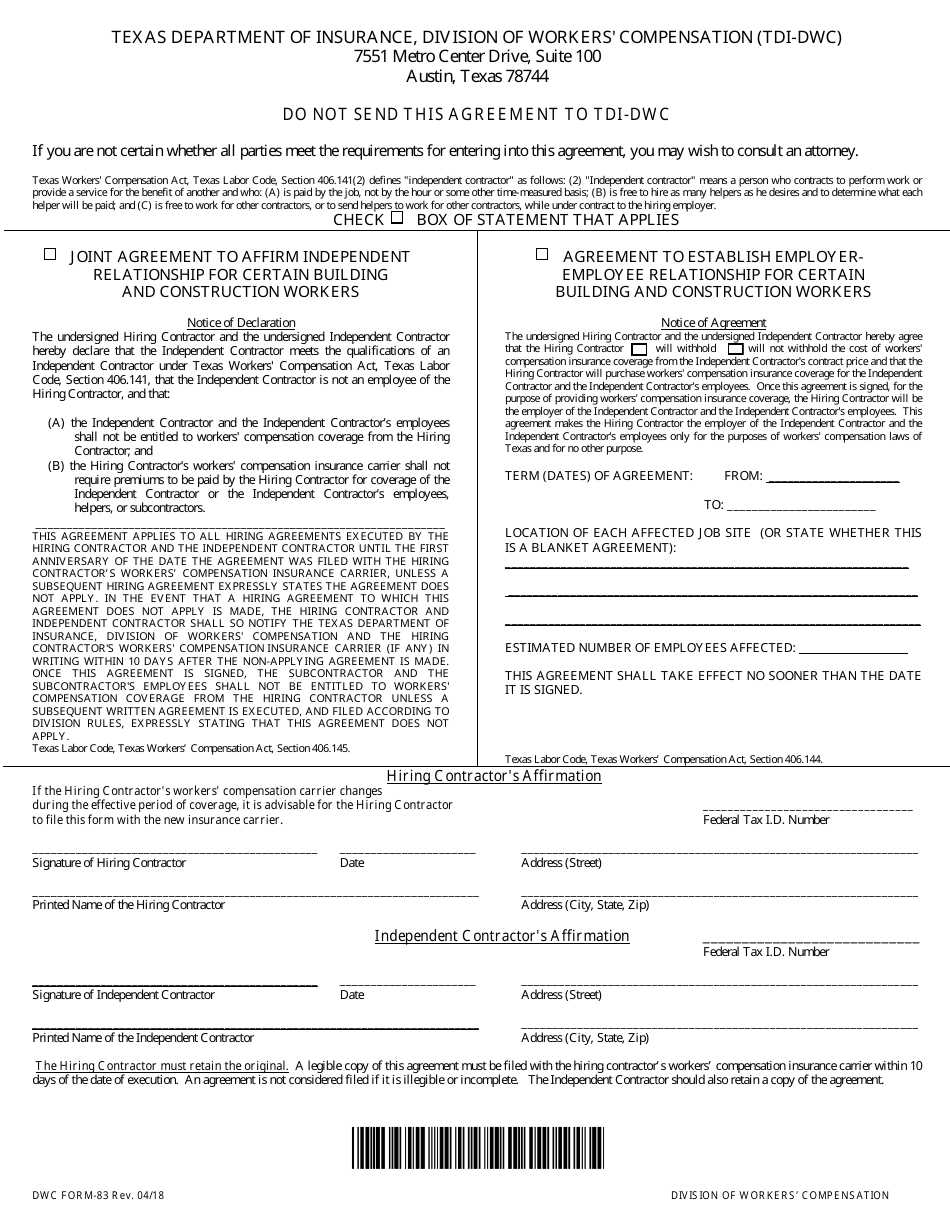

Workers Compensation Texas Law.

. Past due taxes are. Spread Payments Throughout Your Policy. Here again there are limits.

If tax is paid over 30 days after the due date a 10 percent penalty is assessed. For workers compensation questions concerning the Uvalde event visit our staff at Family Assistance Center Uvalde County Fairplex 215 Veterans Lane or call us at 800-252-7031. Unemployment Insurance Workers Compensation.

Up to 25 cash back The weekly benefit amount will be 70 of your average weekly wage before the injury. Discover ADPs Workers Comp Premium Payment Program Pay-By-Pay. Past due taxes are.

For the most part you will not have to list workers compensation settlement money as income when filing your. Maximum Tax Rate for 2022 is 631 percent. Minimum Tax Rate for 2022 is 031 percent.

Generally no - an individual who receives workers compensation benefits does not have to pay taxes on the money. The Texas workers compensation statutes are located in Texas Labor Code Title 5. In General Workers Comp Settlements Are Not Taxable.

You pay unemployment tax on the first 9000 that each employee earns during the. Texas workers compensation insurance gives your employees benefits to help them recover from a work-related injury or illness. If tax is paid 1-30 days after the due date a 5 percent penalty is assessed.

The short answer is. Texas unlike other states does not require an employer to have workers compensation coverage. Texas Workers Compensation Act.

If tax is paid over 30 days after the due date a 10 percent penalty is assessed. Subscribing to workers compensation insurance puts a limit on the amount and. Old Law Texas Workers.

Workmans comp in Texas can also help employers. Requires all employers with or without workers compensation insurance coverage to comply with reporting and notification. If tax is paid 1-30 days after the due date a 5 percent penalty is assessed.

Ad No Upfront Workers Comp Insurance Premium Payment. For injuries that happened in fiscal year 2022.

Are The Benefits From Workers Compensation Taxable In Texas D Miller

2022 Federal State Payroll Tax Rates For Employers

Cash Flow Chart Template Lovely Simple Cash Flow Projection Template Balance Sheet Template Flow Chart Template Investment Analysis

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

Form Dwc83 Download Fillable Pdf Or Fill Online Agreement For Certain Building And Construction Workers Texas Templateroller

Lexisnexis Practice Guide New Jersey Workers Compensation Lexisnexis Store

Workers Compensation Index A Topical Guide To California Workers Compensation Law Lexisnexis Store

Construction Worker Houston Texas 1 Construction Worker Risk Management Construction Services

Is Workers Comp Taxable Hourly Inc

Dubreuil S Florida Workers Compensation Handbook Lexisnexis Store

Is Workers Comp Taxable Workers Comp Taxes

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Texas Workers Compensation Handbook Lexisnexis Store

Texas Non Subscriber How Can Injured Worker S Get Compensation

Is Workers Comp Taxable Hourly Inc

Is Workers Comp Taxable Hourly Inc

Stereotypical Worst Things About Every Us State Funny Maps Map Of American States Map

The True Cost To Hire An Employee In Texas Infographic

Cash Flow Chart Template Lovely Simple Cash Flow Projection Template Balance Sheet Template Flow Chart Template Investment Analysis