how to calculate nj taxable wages

Under the FLSA these. The actual amount of tax taken from an employees paycheck is also dependent on their filing status single or married and number.

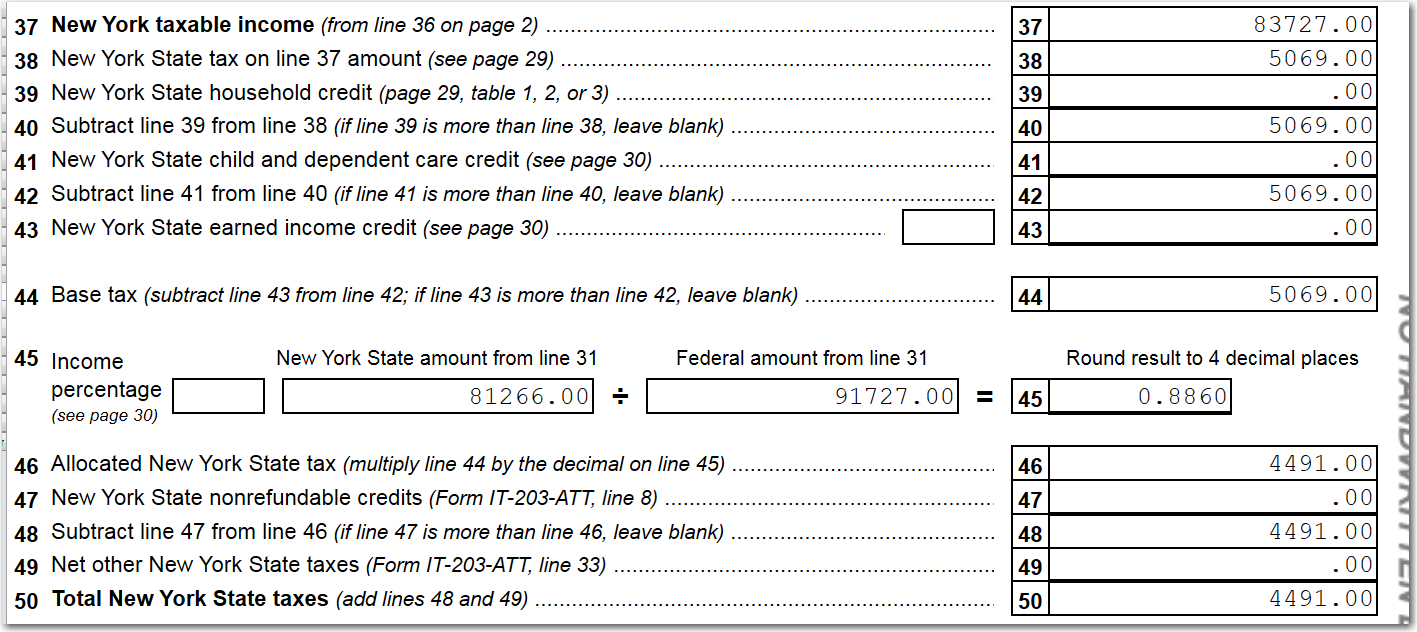

Nj Full Year Resident Ny Wages General Chat Atx Community

This marginal tax rate means that.

. Calculate your payroll tax liability Net income Payroll tax rate Payroll tax liability minus any tax liability deductions withholdings Net income Income tax liability. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck calculator.

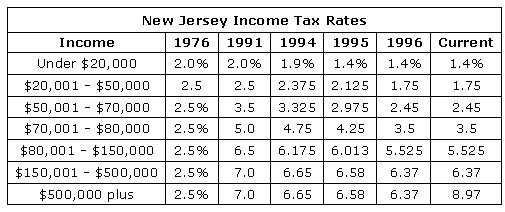

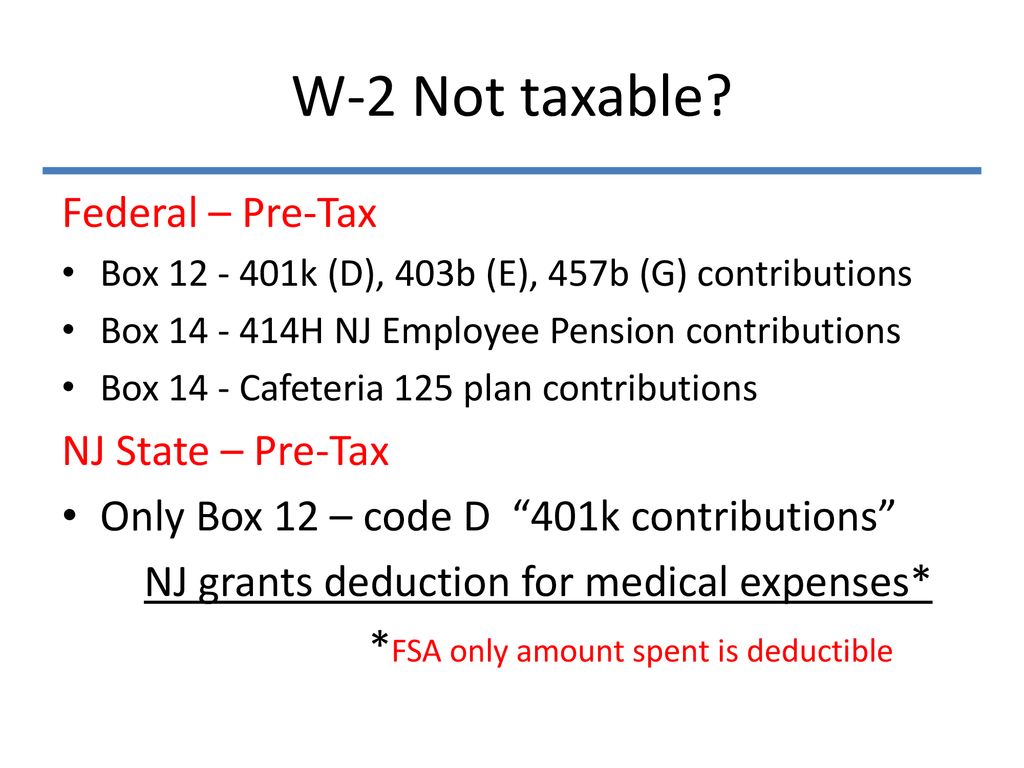

The state income tax rate in New Jersey is progressive and ranges from 14 to 1075 while federal income tax rates range from 10 to 37 depending on your income. Figure out your filing status work out your adjusted gross. Because of these and other differences you must take the amount of wages from the State wages box on your W-2s Box 16.

However if you do not have withholdings or enough withholdings taken out of a paycheck you may have to make estimated payments. Rates for board and room meals and lodging under the New Jersey Wage and Hour laws or regulations may be found at NJAC. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in New Jersey.

To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. 2022 wage tax rate summary for new jersey. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783.

Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Taxable Income in New Jersey is calculated by subtracting your tax deductions from your gross income. Your average tax rate is 1198 and your marginal tax rate is 22.

Also check your W-2 to confirm that New Jersey. This calculator can determine overtime wages as well as calculate the total. Gross wages - Non-taxable wages - Pre-tax deductions Taxable benefits Taxable wages.

Calculate hourly employees wages by. Census Bureau Number of cities with local income taxes. The Official Web Site for The State of New Jersey.

If you estimate that you will owe more than 400 in. Just enter the wages tax withholdings. New Jersey Paycheck Quick Facts.

New Jersey Paycheck Calculator. Calculate hourly employees wages by multiplying the number of hours worked by their pay rate including a higher rate for any overtime hours worked. 1256-8 1256-13 and 1256-14.

Incredibly a lot of people fail to allow for the income tax deductions when completing. Using our New Jersey Salary Tax Calculator. New Jersey income tax rate.

The best payroll software tools that calculate taxable wages for you.

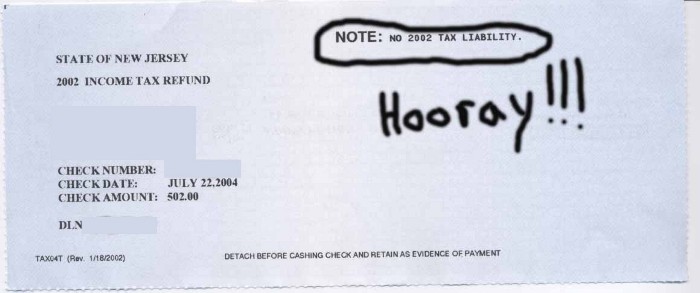

Nj State Income Tax Surprise Penalty R Tax

Nj Dot Nj 630 2014 Fill Out Tax Template Online Us Legal Forms

Solved I Received State Disability From New Jersey Is That Taxable I Do Not Have A 1099 G I Have A Form W 2 With Money On Number One For Wages

State Individual Income Tax Rates And Brackets Tax Foundation

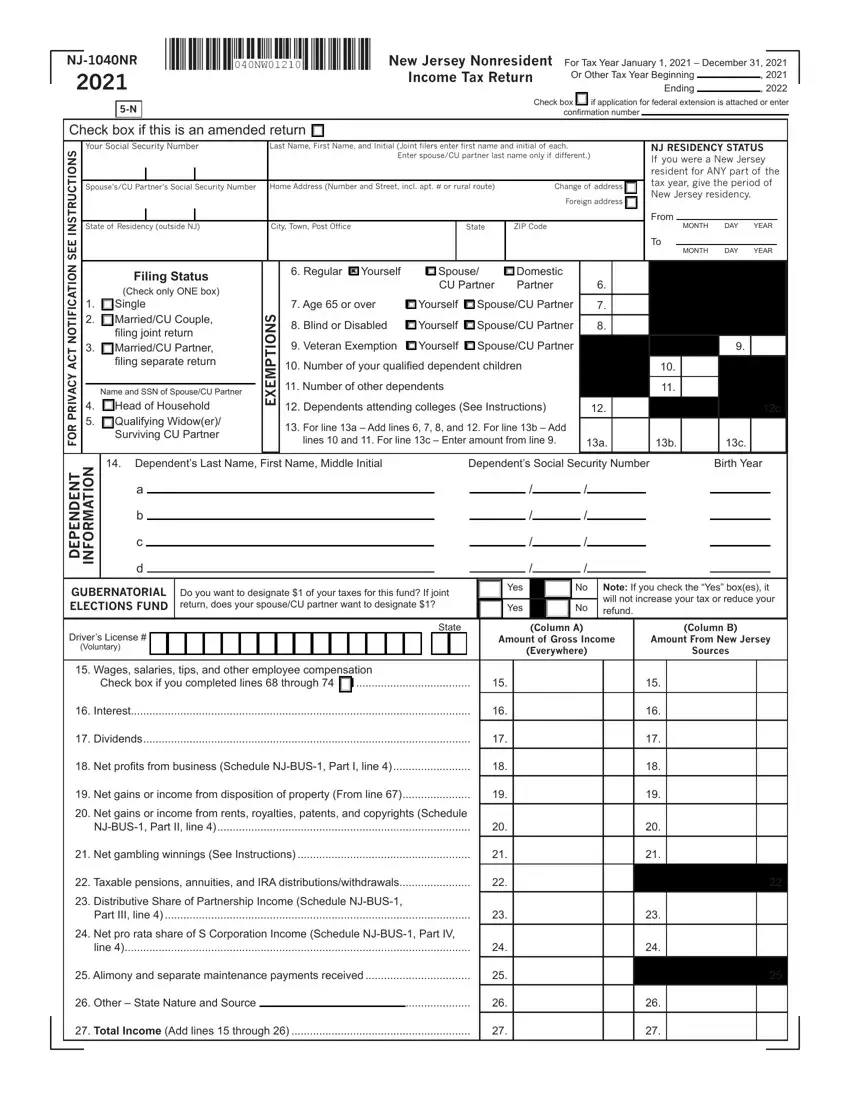

Nj 1040nr Form Fill Out Printable Pdf Forms Online

![]()

Free New Jersey Payroll Calculator 2022 Nj Tax Rates Onpay

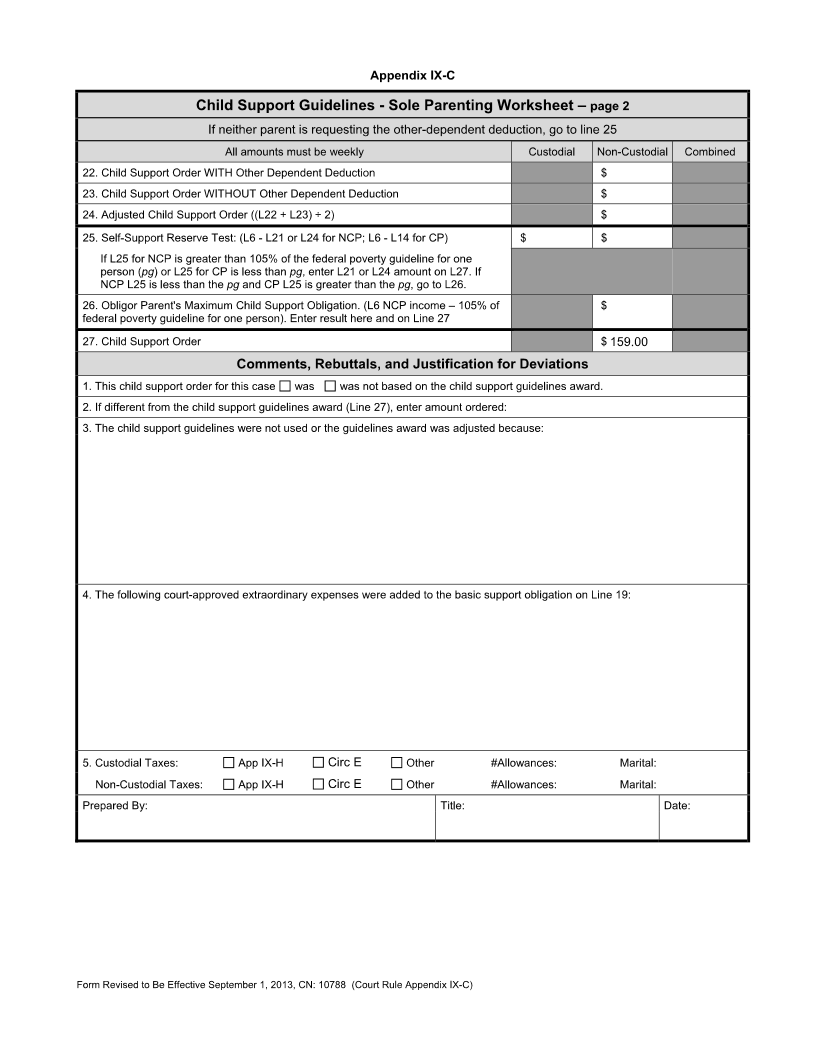

How Much Child Support Will I Pay In New Jersey

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Re My Nj Tax Return Not Picking Property Tax Deduction But Instead Picking A Credit Page 2

Pension Income Not Correct On New Jersey Return

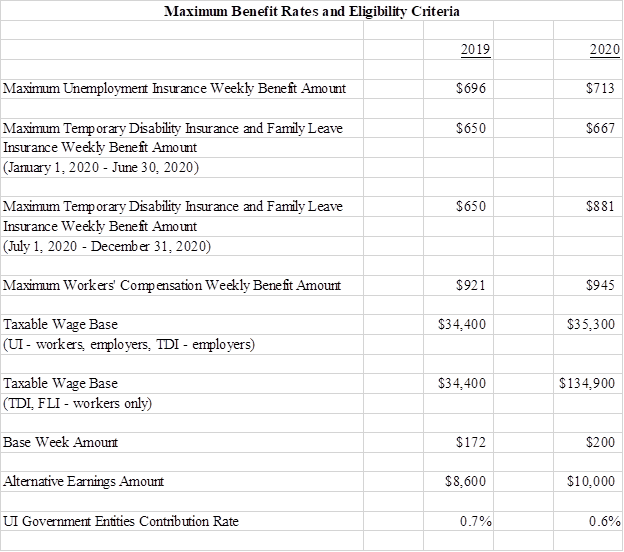

Department Of Labor And Workforce Development Nj Labor Dept Max Benefit Rates Increase On Jan 1

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

5.jpg)

Set Up Rates And Withholdings Das

Understanding W 2 Box 1 Federally Taxable Wages Tips And Other Compensation Line 7 On 1040 Box 2 Federal Income Tax Withheld Line 64 On 1040 Box Ppt Download